The no-fault system aims to lower the cost of car insurance by taking small claims out of the courts. In other words, no-fault removes an individual’s ability to sue after a car accident.

Instead, if a person has no-fault insurance and is involved in a car accident, their insurance company will pay for minor injuries, no matter who was at fault in the accident. Neither driver is allowed to sue one another unless they have suffered a serious injury or if their injuries meet a certain monetary threshold, which differs from state to state.

Going Outside the System

There are generally two types of thresholds under which the victim of a car accident may go outside the no-fault system to pursue a claim against another driver.

Medical expense thresholds.

For the victim of a car accident to go outside the no-fault system in their state, their medical bills must exceed a specific dollar amount. The medical expenses that count toward this threshold include:

- Ambulance, hospital, clinic, and laboratory costs

- Doctor and nurse expenses

- Physical therapy and chiropractic expenses

There is a catch: some at-fault drivers’ insurance companies will argue that a victim’s expenses are unnecessary and therefore do not meet the medical expense threshold, meaning the victim cannot sue. They may argue that the cost of your treatment should not be figured into the medical expense threshold if they believe it is not related to the car accident or that it was not necessary to treat your injuries.

Serious injury thresholds.

For a car accident victim to step outside the boundaries of a no-fault system and be able to file a claim against another driver, they must demonstrate that they suffered significant, sometimes life-threatening injuries. The parameters that determine if a victim suffered a “serious injury” differ from state to state, but some of the common ones are:

- Death

- Dismemberment

- Loss of a fetus

- Significant or permanent scarring

- Significant disfigurement

- Significant and permanent loss of an important bodily organ, system, or function

- Permanent or significant limitation of a bodily organ or member

Even with state definitions and statutes, it can be extremely confusing to determine what distinguishes a “significant” impairment or limitation or an “important” bodily function. It can be frustrating to be debilitated and still not receive the compensation you deserve for medical bills and expenses.

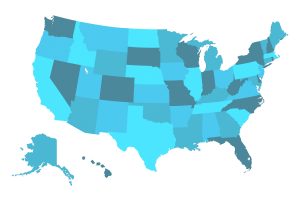

States That Allow Car Accident Victims to Use a Serious Injury Threshold

- The District of Columbia

- Florida

- Hawaii

- Kansas

- Kentucky

- Massachusetts

- Michigan

- Minnesota

- New Jersey

- New York

- North Dakota

- Pennsylvania

- Utah

States That Allow Car Accident Victims to Use a Monetary Threshold

The following states allow car accident victims to go outside a no-fault system if the cost of their medical expenses exceeds their insurance policy’s PIP (Personal Injury Protection) amount.

- The District of Columbia

- Hawaii

- Kansas

The following states allow victims to go outside a no-fault system if they meet a specific dollar threshold between $1,000 and $4,000 (the exact amount depends on the state):

- Kentucky

- Massachusetts

- Minnesota

- North Dakota

- Utah

No matter your location or policy terms, consult with a car accident attorney. They will provide professional advice on which no-fault option would be best for you to work with. The right attorney can help you navigate insurance, provide legal assistance, and make sure you receive the compensation you need.